Posts

Which have an adaptable Cd, we’re going to waive early withdrawal penalty but in connection with one withdrawals you request in the earliest 6 days of the new account identity (and/or very first six days pursuing the any limited detachment). See Deposit Contract and you may Disclosures and you can Put Price Piece for much more detail regarding the penalty formula. Link your bank account for the Financial of The united states Advantage Matchmaking Financial, Bank from The usa Advantage with Tiered Desire Examining otherwise Lender out of America Virtue Regular Checking Profile (first cuatro discounts membership). Ask me to link your finances Industry Protecting account to your Bank out of The united states Virtue Matchmaking Financial, Financial out of The united states Advantage which have Tiered Attention Examining or Bank from The usa Advantage Regular Checking Account (very first cuatro offers profile).

Once you’ve enlisted, you’ll found an email verification, and also you’ll anticipate to to remain and you will manage your profile. You can also download the major-ranked Wells Fargo Mobile application from the Fruit App Shop or Google Enjoy and you will do the banking from anywhere. Juntos Avanzamos appointed borrowing from the bank unions come in certain states and you can features quick branches as they suffice primarily underserved and regional communities. Usually, Latina People in america had been influenced by discriminatory financing strategies you to definitely limited its opportunities to own financial gains. But not, this type of methods do not affect the lender, nor will it negate the main role banking takes on if seeking to to manage currency or make a funds.

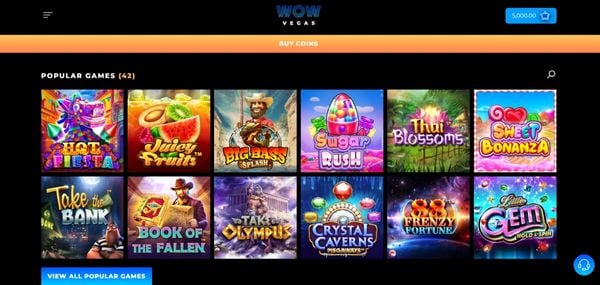

RealPrize sweepstakes casino features many 100 percent free-to-gamble games, free money incentives, discover this and you will a lot of pick alternatives — in addition to specific below $5. Something we like about any of it societal gambling enterprise is their 500+ games library filled with Viva Vegas, CandyLand, and you can Infinity Ports, categories to mention a few. Sweepstakes gambling enterprises appear inside the more than 45 says and therefore are always free to fool around with just what are named Coins (otherwise comparable).

Flat security dumps because the off repayments

Clients could possibly get gather injuries of landlords which break that it laws, and therefore relates to all leases except owner-filled dwellings which have less than five equipment (Real property Legislation § 223-b). It is unlawful to possess landlords within the Nyc in order to retaliate up against clients to possess doing occupant communities. It’s very unlawful for landlords inside Ny so you can retaliate up against tenants just who build a good faith problem on it or so you can a federal government agency in the abuses from safe practices legislation, problems with habitability or low-repair of your own premises, abuses away from liberties below a rent, or rent gouging.

- Of many claims limitation exactly how much might be energized to possess shelter deposits for rental products.

- The fresh authored observe from denial shall are the statewide legal help contact number and site address and you can should upgrade the new applicant you to the guy must believe his straight to problem the brand new assertion within this seven times of the brand new postmark time.

- Although not, almost every other online banking companies may still offer a lot more competitive rates of interest.

- The bill introduced merchandising an online-based betting court on the Huge Canyon Reputation.

When the a property manager lies or deliberately misrepresents regulations to help you a great tenant, this may also make-up harassment. Significant bothering run will get make up unlawful eviction and you will landlords is generally subject to each other municipal and you may criminal punishment, in the way of a category An offense to possess harassment less than Real property Rules § 768. Landlords have to render reasonable apartments to have clients which have disabilities so they really could possibly get enjoy equal usage of and employ from housing leases. Tenants within the oil-hot numerous dwellings get offer having an oil agent, and pay money for petroleum deliveries on their building, in the event the property owner does not make sure an adequate electricity also have.

Mandatory electronic processing

Common Perks Diamond Remembers participants using a financial of The united states Debit otherwise Atm credit won’t be recharged the new International Exchange Fee and/or non-Lender away from The usa Automatic teller machine fee for withdrawals, transmits and you may equilibrium questions from non-Financial away from America ATMs inside a foreign country. For individuals who look after the very least everyday equilibrium out of $2500 or higher inside account or you is actually enlisted regarding the Preferred Rewards system, you’ll not become billed that it payment. With Harmony Connect to have overdraft security, if you are planning to overdraw your account, we are going to automatically import offered funds from the connected content membership(s). Only 1 import fee try charged every single safeguarded account for each go out you to a transfer is established.

Generous Improvements within the Book-Controlled Equipment:

If you sign in, CBSA does not decelerate the fresh books for GST/HST research and collection, and you will Canada Post cannot charge the newest $9.95 postal handling commission. You may even have the ability to recover the newest GST/HST you have to pay to the people goods otherwise features you familiar with deliver the guides in the Canada (from the stating an enthusiastic ITC). When you are an excellent GST/HST registrant, play with CBSA Function B2 to consult a modifications for a keen overpayment of lifestyle obligations, GST and/or federal an element of the HST for the brought in merchandise. As the CBSA approves your own request, you may also document Form GST189 to recoup the newest overpayment of the GST or perhaps the federal the main HST to the brought in merchandise. If your promotion allege involves a lifestyle matter for example a good redetermination out of tariff category or reappraisal useful for obligations, do not document Form GST189 up until CBSA approves your own Setting B2 request. Next use the CBSA decision to help with their allege on the rebate of one’s GST and/or federal area of the HST.

Plenty of preferred advice for to try out inside online casinos is geared toward larger deposits, especially if you don’t reload your bank account apparently. To simply help participants figure out what will work best from the a minimal put local casino $5, we’ve outlined some easy tips to help you improve your odds of effective and possess an unforgettable casino experience. While you are many of these might not apply to your, chances are that many have a tendency to. Something that 888 Gambling enterprise is known for is actually lower lowest dumps to their invited extra.

Base their calculations for the offers built in the newest financial 12 months you to simply concluded. For more information and you will line-by-line instructions about how to submit the GST/HST get back utilizing the quick approach, find Book RC4058, Brief Type Bookkeeping to own GST/HST. Were sales away from financing personal possessions and you can improvements to help you such property if you utilize the property over fifty% on your commercial items.

The basic speed is dependant on the speed charged on the 90-date Treasury Debts, modified every quarter, and you can rounded to the fresh nearby entire percentage. In such cases, you have got to have fun with one of several most other submitting tips explained within section. For builders who are in need of considerably more details, see GST/HST Information Sheet GI-099, Builders and you may Digital Filing Requirements, to aid determine the fresh submitting alternative that will otherwise should be used. You could pay the a fantastic amount on the web at the Spend today using my Fee.

To accomplish this, utilize the CRA’s online characteristics at my Team Account otherwise Depict a customer, otherwise complete and publish Mode GST74, Election and you will Revocation away from an enthusiastic Election to utilize the newest Small Method out of Accounting to help you their tax services office. For many who import goods to the Canada and you’re not a good GST/HST registrant, you simply can’t allege a keen ITC to the GST or perhaps the government area of the HST in respect of your own importation. However, for many who provide the brought in items, and deliver or cause them to available in Canada, to help you an excellent GST/HST registrant, one to registrant could possibly claim the brand new GST or the government area of the HST paid-in regard of your own importation while the an enthusiastic ITC. If you allow the registrant a suitable proof one your repaid the fresh GST or even the federal area of the HST when you brought in the products, you could potentially bequeath the fresh ITC compared to that registrant. Satisfactory research has a copy of Canada Border Services Agency (CBSA) Function B3-step three, Canada Lifestyle Programming Form, proving that GST or the government part of the HST try paid during the time of transfer. If you are a keen importer, you have to pay the fresh GST or even the government section of the brand new HST of all industrial goods your import to the Canada, whether or not you’re a great GST/HST registrant.

To learn more in the international exhibitions, go to Foreign Meeting and you can Tour Incentive System, otherwise find Publication RC4036, GST/HST Suggestions to your Take a trip and you may Conference Globe. When you’re the newest mentor away from a different convention, you can’t sign up for the fresh GST/HST if your simply industrial hobby in the Canada is creating sales of admissions or related seminar provides otherwise local rental exhibition area in the a different conference. Although not, for many who promote guides, posters, knowledge thing, or other items from the overseas conference, you might be in a position to, or if you might have to create the new GST/HST. If you undertake not to ever sign in, you never charge the brand new GST/HST, therefore usually do not claim ITCs. Carrying-on team implies that the business interest is completed on a regular basis otherwise continually. Per case are analyzed on its own items including the person’s records and you may intentions.